What is GTIP and Why Is It Important? 5 Ways to Optimize Your Trade

What is GTIP?

GTIP (Customs Tariff Statistical Position) is a 10-digit code used for the classification and taxation of products in international trade. This code is vital for importers and exporters to complete their trade transactions accurately and efficiently. GTIP codes classify products based on their origin, type, and intended use, ensuring a standardized approach to customs duties and tariff applications.

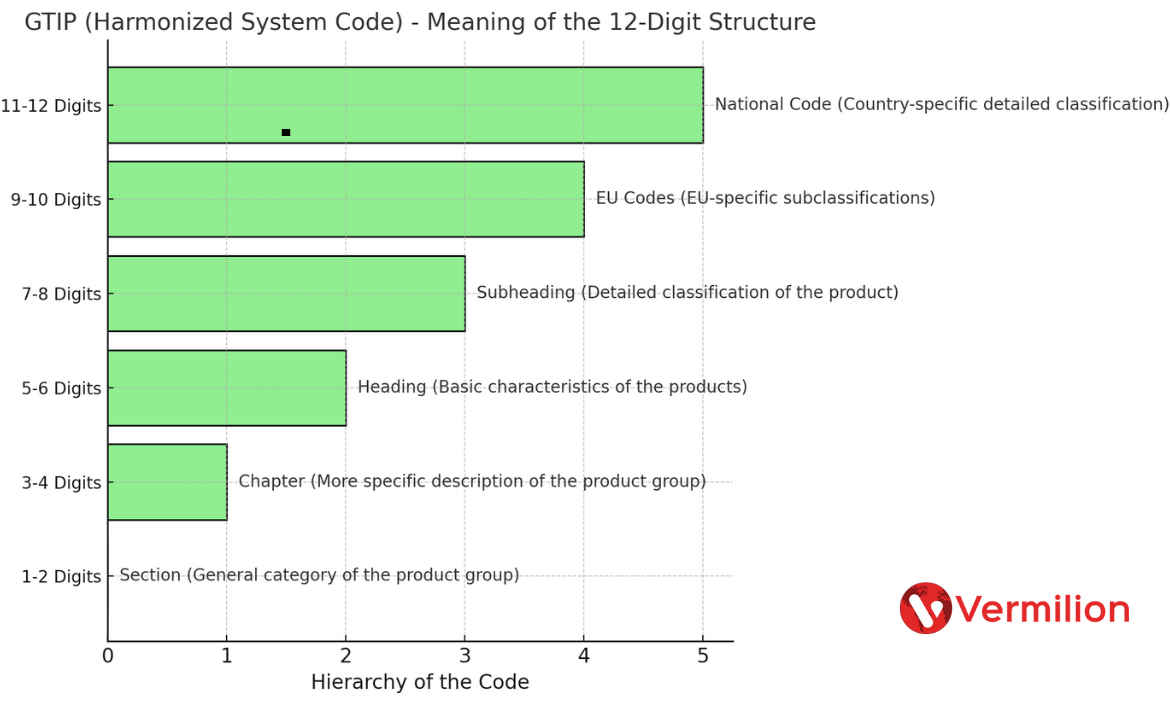

GTIP Code Structure Explained

- 1-2 Digits: Section – General product category (e.g., chemicals, textiles)

- 3-4 Digits: Chapter – More specific product definition (e.g., cotton fabrics within textiles)

- 5-6 Digits: Heading – Core product characteristics (e.g., woven cotton fabrics)

- 7-8 Digits: Subheading – Detailed product classification (e.g., cotton fabrics of a specific weight)

- 9-10 Digits: EU Codes – Additional classifications specific to the European Union

- 11-12 Digits: National Code – Country-specific detailed definitions

This structured approach ensures accurate product classification in international trade and supports smooth customs clearance and appropriate tariff application.

Why is GTIP Important?

GTIP codes play a critical role in international trade, impacting several key areas:

1. Accurate Tax Calculation

GTIP codes help determine the correct tax rates for products during import and export, allowing for more precise financial planning.

2. Trade Statistics

Governments use GTIP codes to compile and analyze trade statistics, which help shape national and international trade policies.

3. Free Trade Agreements

A proper GTIP code ensures compliance with free trade agreements, allowing businesses to benefit from reduced customs duties.

4. Faster Customs Procedures

Correct GTIP coding speeds up customs processes, preventing delays and additional costs caused by misclassification.

5. Legal Compliance

Incorrect GTIP codes can lead to fines and legal penalties. Proper classification is essential for regulatory compliance and smooth trade operations.

5 Effective Ways to Optimize Your GTIP Process

1. Apply Correct Coding

Ensure your products are accurately coded to avoid customs delays and unexpected costs. Misclassification can lead to operational inefficiencies.

2. Utilize Digital Tools

Speed up your GTIP processes using online resources such as the EU TARIC System, which helps you find the right GTIP codes for your products.

3. Collaborate with Professional Logistics Partners

Working with logistics companies experienced in GTIP processes, like Vermilion’s Customs Solutions, can save you time and costs by ensuring accurate coding and efficient customs clearance.

4. Educate Your Team

Provide training on the importance of GTIP codes in trade operations to reduce errors and increase efficiency.

5. Optimize Your Supply Chain

Work closely with your suppliers to ensure the correct GTIP codes are applied, improving the accuracy and efficiency of your logistics processes.

How to Determine Your GTIP Code?

Accurately identifying your GTIP code is crucial for success in international trade. Follow these steps:

1. Analyze Your Product Details

Review your product’s material, production method, intended use, and technical specifications thoroughly to find the most accurate GTIP code.

2. Use Reliable Online Resources

Platforms like the EU TARIC system help businesses identify the correct GTIP code by providing a detailed breakdown of product categories and specifications.

3. Get Expert Assistance

For more complex classifications, consult with customs experts or logistics professionals, such as Vermilion, who can guide you through the GTIP process efficiently.

4. Monitor Current Regulations

GTIP codes are periodically updated. Keeping track of regulatory changes can prevent classification errors and legal issues.

The Advantages of Using GTIP Codes

1. Cost Reduction

Applying the correct GTIP code helps avoid unnecessary tax payments, contributing to a more profitable business operation.

2. Improved Trade Efficiency

Accurate coding facilitates faster customs procedures, enhancing delivery times and customer satisfaction.

3. Legal Protection

Using the correct code helps businesses avoid fines and ensures compliance with international trade laws.

Common Questions About GTIP Codes

1. How Can I Find My GTIP Code?

You can use tools like the EU TARIC System or national resources like the Customs Tariff Schedule provided by the Ministry of Trade.

2. Do GTIP Codes Change?

Yes, GTIP codes can change according to trade regulations. It is crucial to regularly review updates to maintain compliance.

3. What Happens If I Use the Wrong GTIP Code?

Incorrect GTIP coding can lead to delayed customs clearance, additional costs, and potential legal issues.

Simplify Your Trade with GTIP Codes

GTIP codes are an essential part of international trade, offering benefits such as cost optimization, faster customs processes, and legal compliance. By implementing digital tools and seeking expert support, businesses can streamline their trade operations and enhance efficiency.

For tailored solutions to manage your GTIP processes, visit Vermilion’s Logistics Solutions and explore how we can help optimize your trade.